On the National Tax Conference held on 17th July 2018 Malaysias Finance Minster Lim Guan Eng stated that the government will incur a 10 tax on sales of goods and 6 tax on. The GST-03 returns and payment for taxable.

Sst Simplified Malaysian Service Tax Guide Mypf My

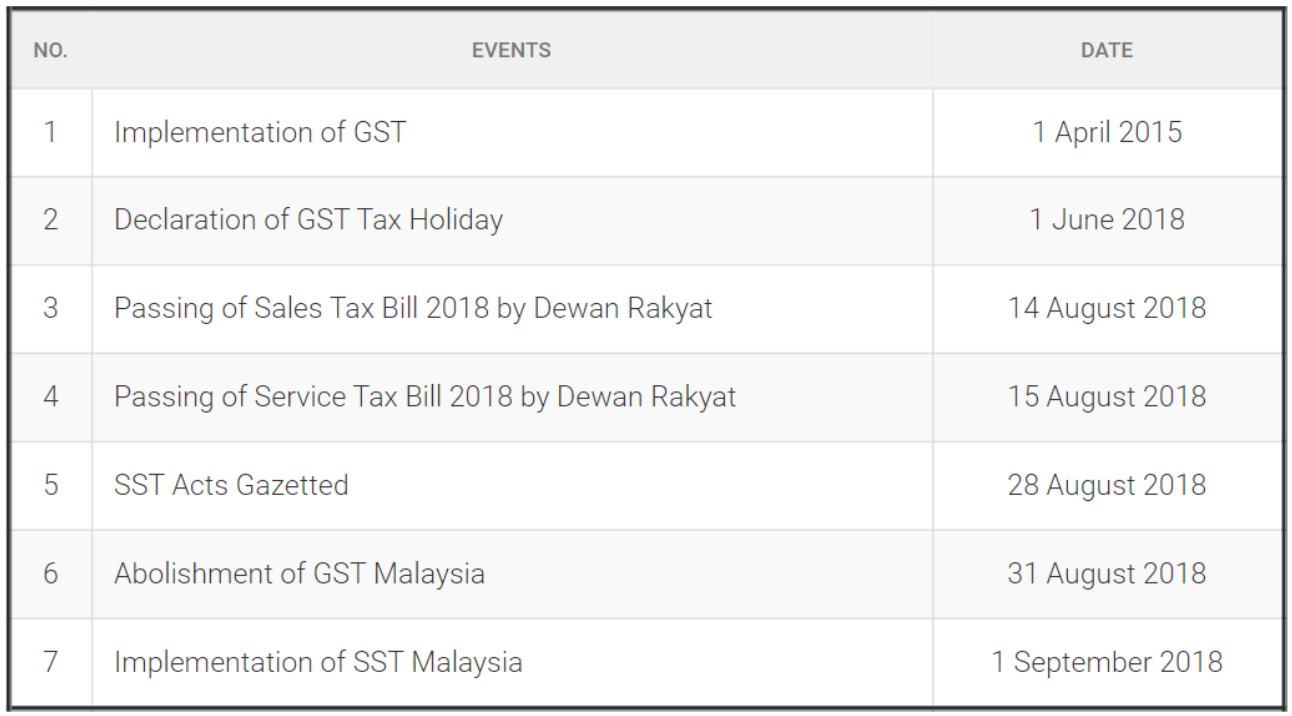

Malaysia has tabled at Parliament the implementation bill for its Sales and Service Tax SST which comes into force on 1 September 2018.

. This sales and tax service is governed by the Royal Malaysian Customs Department. The Sales Tax is a single-stage tax charged and levied on taxable goods imported into Malaysia and on taxable goods manufactured in Malaysia by a taxable person and sold by. Companies that registered for the SST should file a report every 2 months and the first taxable period is from September to October 2018.

The SST-02 return should be. Sales and service tax SST has been doing well in Malaysia before it was replaced a few years backIt stands for 10 percent for sales tax while service tax will be charged 6 percent according. Service Tax Regulations Service Tax Regulations 2018.

SST in Malaysia was introduced to replace GST in 2018. Sales Tax Act and Service Tax. Sales tax a single.

It is replacing the 6 Goods and. Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in MalaysiaThe SST consists of 2 elements. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1.

Account for transactions from 1st Aug to 31st Aug 2018 only. Final GST taxable period is 31st August 2018. Effective 1 September 2018 the Malaysian Government has replaced the Goods and Services Tax GST with Sales and Service Tax SST.

The current tax rate for sales tax is 5 and 10 while the service tax rate is 6. Sales Tax Regulations Sales Tax Regulations 2018. In this regard Bursa Malaysia Berhad.

Master Exemption List MEL and the importer of such items that is petroleum upstream operator will be given an exemption from sales tax subject to prescribed conditions as stated in the. A taxable person is a person who provides taxable services in the course or furtherance of business in Malaysia and is liable to be registered or is registered under the. If your company is already GST-registered the MySST.

SST consist of 2 separate act. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia.

Amendment 12019 Sales Tax Determination Of Sale Value Of Taxable Goods Regulations 2018. Following the announcement of the re-introduction of Sales and Services Tax SST that will kick start on 1 September 2018 the Royal Malaysian Customs. The Service Tax rate is fixed at 6 and the list of services subject to it include hotels insurance gaming legal and accounting services employment agencies parking.

A 6 rate has been fixed for SST by the Ministry of Finance on 1st September 2018. Here are the details on how the SST works - the. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

1st Aug 2018 to 31st Oct 2018. A manufactured in Malaysia by a registered manufacturer and sold used or disposed of by him. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia.

Malaysia Sales Tax 2018. Or b imported into Malaysia by any person. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy.

List Of SST Regulations. SCOPE CHARGE Sales tax is not charged on.

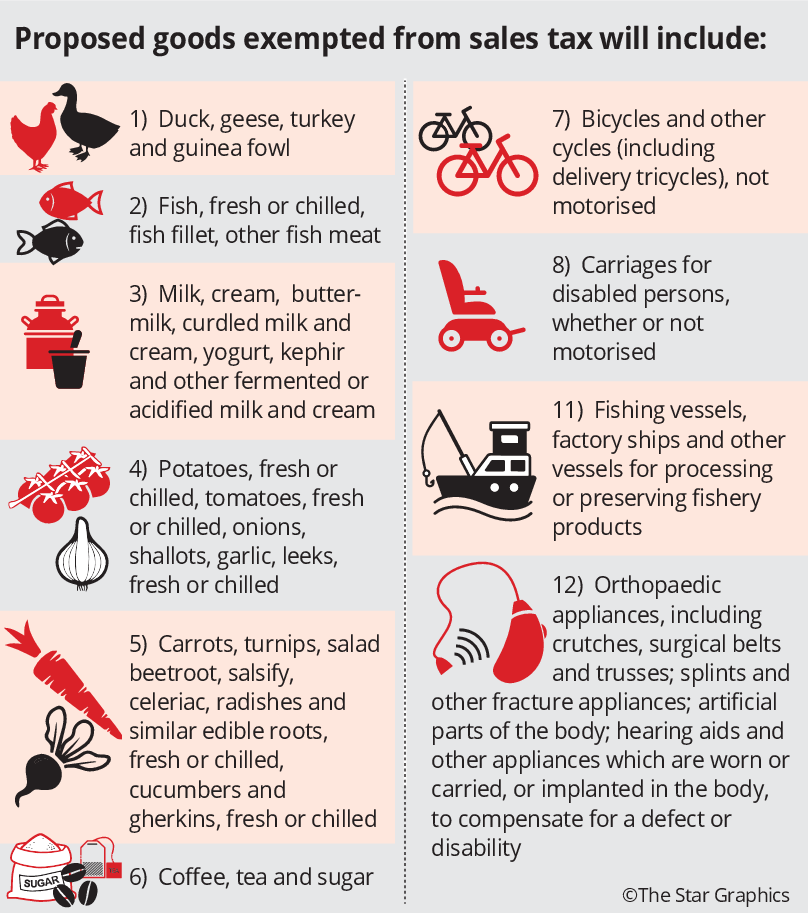

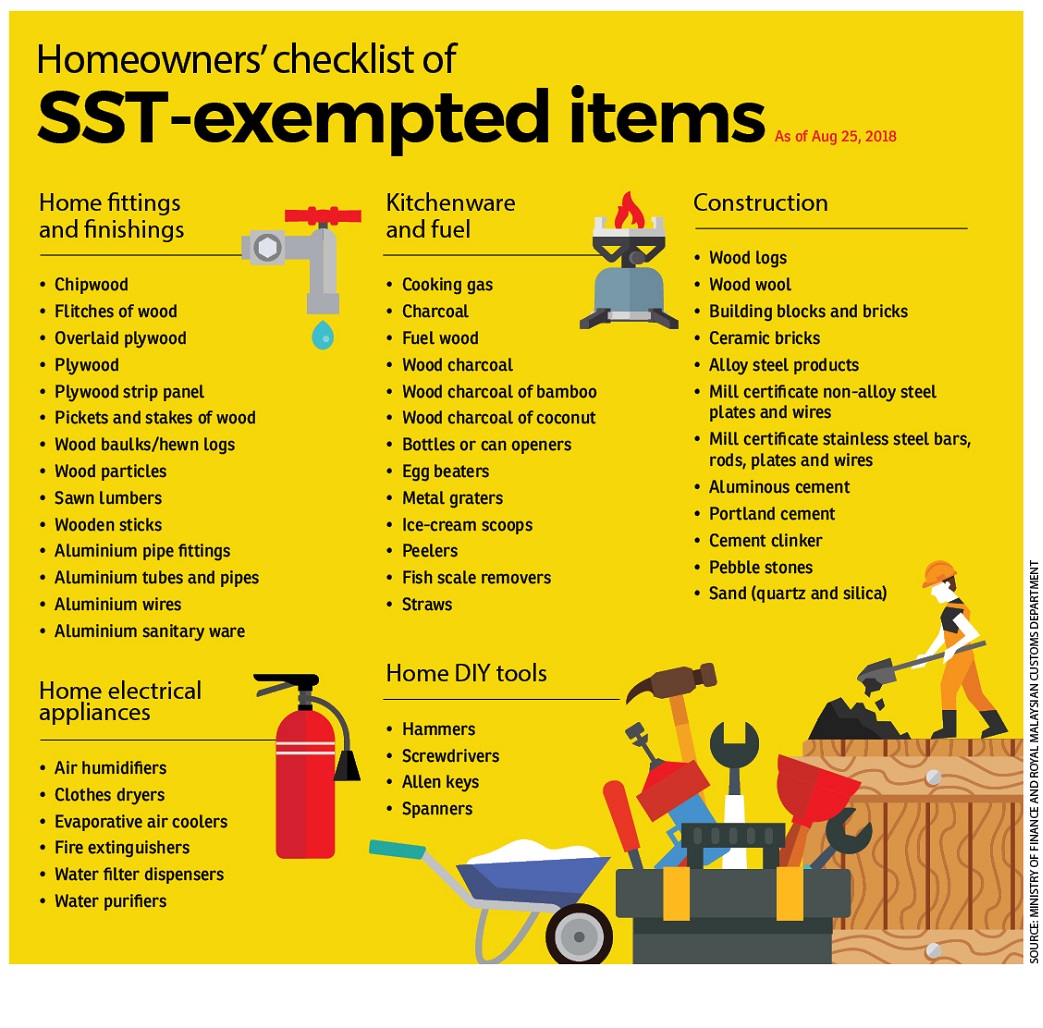

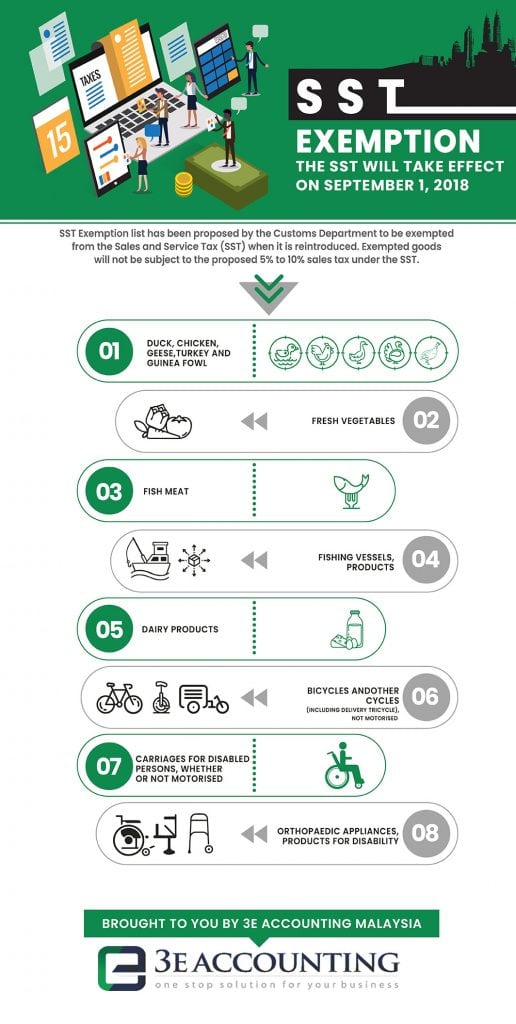

Essential Items Will Be Exempted From Sst

Sst Will Property Prices Come Down Edgeprop My

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sst Honda Releases New Prices Up To Rm4 9k Cheaper Paultan Org

Goods And Person Exempted From Sales Tax Sst Malaysia

Sst Nissan Price List Cheaper By Up To Rm5 400 Paultan Org

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Malaysia Sst Sales And Service Tax A Complete Guide

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Sst Sales And Service Tax A Complete Guide

![]()

Mercedes Benz Malaysia Announces New Sst Price List While Glc Gets Safety Updates

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

How Is Malaysia Sst Different From Gst

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sst Mercedes Benz Price List 19 Models Up 6 Down Paultan Org

Sst Simplified Malaysian Sales Tax Guide Mypf My